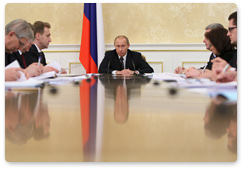

Prime Minister Vladimir Putin chaired a meeting on economic issues

3 february 2009

Vladimir Putin's opening address:

Good afternoon, esteemed colleagues,

We will discuss the banking situation today.

The Russian Government and Central Bank made urgent steps to support the banks in the last months of 2008.

The private deposit insurance sum increased from 400,000 roubles to 700,000 to retain public confidence in banks.

An unprecedented sum exceeding 3 trillion roubles was allocated to support bank liquidity apart from the approximately 380 billion roubles that remained at bankers' disposals with the reduction of reserve requirements.

In addition, the leading banks received subordinated loans-in particular, 500 billion roubles went to Sberbank, 200 billion roubles to VTB, and 25 billion roubles to Rosselkhozbank.

Other commercial banks can get subordinated loans worth another 225 billion roubles if private holders offer co-financing.

Subordinated loans to three banks for more than 17 billion roubles have been approved, and 38 applications totalling 70 billion roubles are under consideration.

The federal budget and state corporations have made considerable bank deposits.

Last but not least, the Deposit Insurance Agency has begun rehabilitating banks that cannot cope with their obligations in the current situation. The federal budget has allocated 200 billion roubles for the purpose.

I deem it necessary to stress that all these measures are being taken not to keep particular banks and their holders afloat-though we would not be ashamed if this were the case. Above all, the Government and the Central Bank mean to prevent an overall national banking crunch. Troubleshooting boils down to preserving private deposits, guaranteeing payments and settlements, and further industrial crediting.

As for private individuals and other participants in economic activities, we have fully maintained currency exchange and the opportunity to dispose of money at one's own discretion. I think we have coped.

Today, it is high time to summarize what we have done and discuss further steps to support banks.

Evidently, Russian companies will be unable to make foreign loans on the same previous beneficial terms in the near future, seeing as the West has economic and financial problems. This is why our banking system should replace this source and ensure the necessary amount of industrial crediting at acceptable, economically substantiated interest rates.

The task demands, first, a reliable resource basis, which implies attracting deposits.

Second, we must evaluate the possible ways of increasing the equity capital of state and commercial banks.

Third, I deem it necessary to make the Russian financial system more competitive through bank enlargement. We have adopted a law facilitating banking mergers and acquisitions.

At the same time, it is hard to object to the Central Bank, as it warns that the matter demands cautious attitudes. By this, I mean guaranteeing the necessary amount of regional banking services, since regional banks need less time than major banks based in large cities to contact clients in Russia's remote regions.

Last but not least, government aid to banks is not charity. As I have said, banks will eventually reimburse allocations, and those allocations should not go to financial ventures but be used as industrial loans. We must not allow our banking system to revert to what it was 200 or 300 years ago. It must remain a modern financial system.

And another thing-both government agencies and the Central Bank of Russia should effectively monitor the situation and the use of government allocations.

That is all I want to say for starters.

Let us proceed with our agenda.