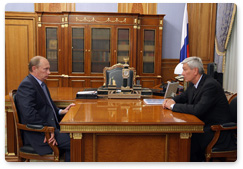

Prime Minister Vladimir Putin meets with head of the Federal Service for Financial Monitoring Yury Chikhanchin

Transcript of the beginning of the meeting:

Vladimir Putin: Mr Chikhanchin, you recently attended the FATF (Financial Action Task Force on Money Laundering) plenary session, where Russia reported on the performance of our financial investigation service. Was it useful? Did you consult with colleagues? What do you think about your agency's performance in different sectors of the economy, industries, the housing and utilities sector, and others? What's the situation in the financial sector, in your opinion? Please.

Yury Chikhanchin: Yes, the FATF recently held a plenary session, during which Russia delivered a report. The main positive effect of our efforts is that Russia has managed to retain its international ranking after a thorough review by experts. Today Russia is at the same level as Sweden, Canada and Italy. Russia has the fifth best financial investigation service in the world. It's a great accomplishment. I'd like to thank you for your support.

We managed to sort out a few more issues at the FATF. We managed to resolve the issue of the membership of the Eurasian Group, created several years ago on the model of the FATF at Russia's initiative. Thanks for supporting this idea. We now have two votes in the FATF.

We were able to help our partners in the CIS and the Eurasian Group. Turkmenistan was removed from the blacklist. As you know, the FATF drew up new sanction lists following a decision of the G20. We also helped Ukraine and Azerbaijan to improve their rankings, and they have a good chance of getting off gray lists at the next plenary session.

India, a new FATF member, is also a good ally here. These aren't the only problems we settled at the forum. I've brought in a slide. We considered new blacklists, sanction lists, as well as gray lists. Unfortunately, we didn't manage to help all our partners, and I think Venezuela will likely be blacklisted.

Our next big challenge at the FATF is a report for the next year, to be compiled according to new rules. To meet this challenge, we need to straighten out a few matters. I have prepared a package of proposals, and I would like your support on them. These measures will allow us to get more government bodies involved in finding a solution. That's everything with respect to FATF.

The effectiveness of Russia's anti-laundering efforts have been recognised around the world. An interdepartmental group was set up to deal with this problem pursuant to a government directive. It includes several ministries and agencies. As the head of this group, I can say that most financial institutions are working well and providing very accurate information, which helps us to address the priority tasks set by the government. We monitor the use of budget funds - I'll speak more about this a bit later. We also monitor the use of funds in the housing and utilities sector, the defence industry, and projects related to preparations for the Sochi Olympics and Student Games. There are some shortfalls and problems here, and we're addressing them together with law-enforcement agencies. The interdepartmental group's cooperation with the Prosecutor General's Office has been very effective. This year we've already submitted information about some 400 companies to it.

Based on the information we receive and review when dealing with one case or another, we agree with other ministries and departments that overall the economy is becoming more stable.

The amount of money transferred abroad from Russia has fallen to 2008 levels. Also, the information we receive from financial institutions has become very accurate, although we probably receive a bit less information than before.

The amount of the funds transferred to countries with favourable tax rates, or offshore countries, has also fallen, and that's a very important index for us. This trend illustrates that businesses are becoming more scrupulous. At the same time, the transparency of the work of several financial institutions is questionable. Unfortunately, they continue to violate law, using gray schemes or even committing more serious illegal acts. I have a slide with information on roughly fifteen banks. We're keeping an eye on them, and we've even begun to investigate some of them. The names of the banks under investigation are highlighted in red. We initiated proceedings against them. Here, in this slide...

Vladimir Putin: Yes, I see.

Yury Chikhanchin: The next slide shows the regions where the transparency of financial operations is questionable. We're working with law-enforcement bodies to sort out the situation in the financial sector of these regions.

Cash turnover rates are suspiciously high in some regions. We understand that capital turnover has a big impact on the development of the national economy... In this slide, you can see that this year more money was cashed in the Samara Region than anywhere else. It's understood that this money is used by criminals, and this exacerbates corruption. After all, this money can be used to fund terrorist attacks.

I'd like to show you one more slide, featuring the scheme that one bank used to move funds to other countries. At the final stage, you can see only six organisations, whereas there are several thousand firms at the outset. They are just fly-by-night companies that use this bank to move cash to other countries. This brings us to conclusion that companies do not always observe the law, and we need to straighten things up here. I've already mentioned that we're working together with the Prosecutor General's Office through a working group ...

Vladimir Putin: How many criminal cases have been opened on the basis of your information?

Yury Chikhanchin: That's shown on the next slide. This year we carried out some 10,000 financial investigations, and as of 2010 about 12,000 criminal cases have been opened based on our information, of which 250 are pure money laundering cases.

Vladimir Putin: This year you mean?

Yury Chikhanchin: Yes, this year. It's not that much, but the scope of these cases is extensive. They are nothing like the cases opened five or six years ago. These are big cases, with a large number of participants, and large-scale financial investigation. There's one case that involves 15 countries. So, these are really big cases to investigate really big cash transactions. We are working on this issue with the Prosecutor General's Office, the Federal Security Service and the Ministry of the Interior. And this work has born fruit: We're dealing not only with individual launderers but also intricate laundering schemes and companies that cash money.