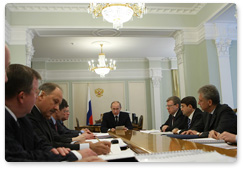

Prime Minister Vladimir Putin chairs a meeting of the Vnesheconombank (VEB) Supervisory Board

The Prime Minister added that Vnesheconombank has also assisted borrowers by offering them loans at affordable interest rates and rescheduling debts, all while adhering to the long-term strategy for Russia’s economic development.

Prime Minister Putin's introductory remarks:

Ladies and gentlemen,

Today we will hear Vnesheconombank's report for 2009, approve the parameters of the budget for 2010 and discuss several projects in which the bank is involved.

The Bank for Development played a critical role in implementing the government's anti-recessionary plan for 2009 by providing emergency aid to the banking sector, the stock market and several strategic companies. The bank's specialists dealt with this challenge as true professionals, implementing all resolutions quickly and successfully. The government also appreciated the assistance provided by the bank's experts.

Several measures carried out with the help of the bank accomplished their objectives and were terminated, with all government allocations refunded. Vnesheconombank has already returned 175 billion roubles to the National Welfare Fund. This money was used to back the securities market in the most critical period of the autumn of 2008, and was returned to the federal budget with interest.

Most of the 54.7 billion roubles in additional revenue earned from these transactions will go to our programme to provide affordable mortgages.

The programme for refinancing Russian companies' debts is being carried out in accordance with our plans to settle debts to international creditors. I would like to remind you that we did this to prevent international lending agencies from obtaining Russian companies' strategic assets at a time when refinancing was difficult because of the global recession. Borrowers have already returned some four billion of the 11 billion roubles they received from VEB.

On the whole, VEB has been actively involved in our efforts to stabilise the banking system, issuing 404 billion-roubles-worth of subordinated loans to other lending agencies. This gave privately owned banks more resources to increase lending in the industrial sector of the economy.

In addition, Sviaz-Bank and Globex Bank, which were on the brink of bankruptcy when they came under VEB management, have restored their solvency. Vnesheconombank specialists are currently working to carry out development strategies for these two banks. Today we will hear a report on the choice of a partner bank for a joint project between Sviaz-Bank and the Russia postal service to create Pochta Bank [Postal Service Bank].

Vnesheconombank was directly involved in the financial rehabilitation of a number of large companies, including United Aircraft Corporation and the Amurmetall plant. VEB contributed 21 billion roubles to UAC's authorised capital, acquiring 11% of the company's shares. In December an agreement was signed for a 2.2 billion-rouble loan for Amurmetall. The first tranche, 400 million roubles, has already been allotted.

Nevertheless, despite its additional anti-recessionary commitments Vnesheconombank continues to work in its main capacity as the Bank for Development.

The bank has recently issued 123 billion-roubles-worth of loans in the industrial sector, which is quite a lot of money. The bank also provided guarantees worth 34 billion roubles to support the export of innovative products, and also allotted 40 billion roubles for small and medium businesses.

VEB has started financing several major projects, including the reconstruction of Koltsovo Airport in Yekaterinburg, as well as the construction of an export terminal for coal in the port of Vanino in the Far East and the Urengoi power station in the Tyumen Region.

Vnesheconombank has also helped to finance future Olympic facilities.

There is one more point I would like to make:

Vnesheconombank has also assisted borrowers by offering them loans at affordable interest rates and rescheduling debts, all while adhering to long-term strategy for Russia's economic development.

Meanwhile, the bank itself has made excellent progress in accumulating sufficient reserves to maintain its financial stability. The bank earned a total of 31 billion roubles in 2009, which is comparable to our leading financial and lending institutions, for example Sberbank.

Obviously, now we must put more effort into rehabilitating and modernising the post-crisis economy and supporting innovation and high-tech exports.

There are several related issues on our agenda today. In particular, we will need to approve a credit line for the construction of the third generating unit at the Ekibastuz power station in Kazakhstan.

I would like to emphasise that all 12 billion-roubles-worth of credit from the Bank for Development will go to purchases of Russian equipment for power stations. We will thus provide Russian manufacturing companies with guaranteed contracts.

In addition, this project will facilitate the reintegration of the power systems of North Kazakhstan and South Siberia, offering more opportunities for these regions' comprehensive development.

The next investment project is the construction of a polypropylene plant in Tobolsk. It's a big construction project, which will have an impact on the future of our chemical industry by increasing the industry's technological prowess and providing opportunities for the deep processing of raw materials.

We will also review the strategic plan for VEB's involvement in developing Sheremetyevo International Airport.

Let's get down to business.